Whispers Beneath the Roar - Markets Hold the Line

2025 has been a year that tested conviction. From renewed tariff disputes and geopolitical flare-ups to stubborn inflation, policy shifts, and a cooling labor market, uncertainty has dominated the narrative. Yet through every headline shock, and even a US government shutdown, global markets have shown one consistent trait: resilience.

As we step into the final quarter, investors face a crossroads. Volatility has not disappeared, but optimism is quietly rebuilding. Easing trade tensions, a Federal Reserve that has finally begun to cut rates, and persistent enthusiasm around AI innovation are reshaping sentiment. The question now is whether this recovery can sustain into 2026, or if the rally has run ahead of fundamentals.

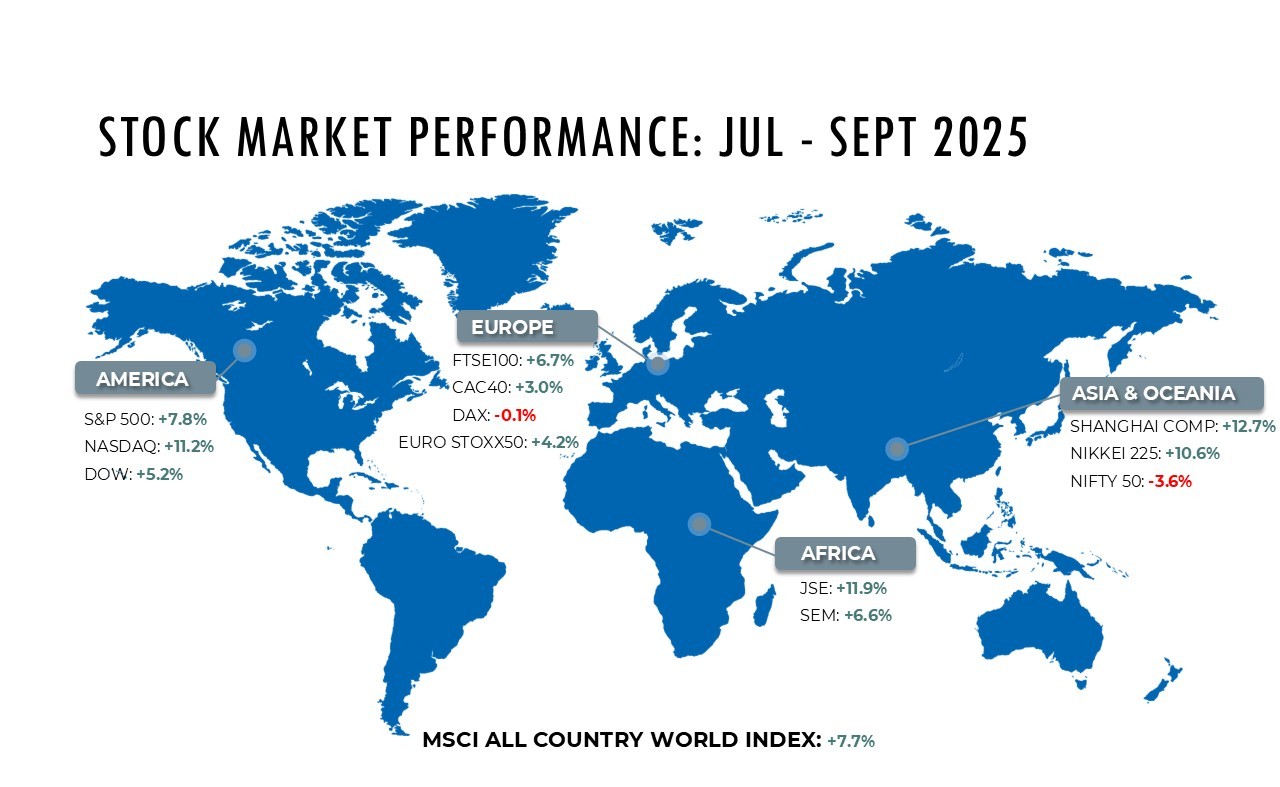

After an 7.8% gain in Q3, the S&P 500 enters Q4 with momentum, though stretched valuations leave little room for policy missteps. The Fed’s first 25-basis-point cut in September signaled the start of an easing cycle, but its pace will determine whether risk assets can sustain their rally. Corporate earnings growth remains encouraging, yet investors should watch for margin pressures as wage dynamics evolve.

UK equities continue to benefit from global exposure and a weaker sterling, even as domestic growth slows. Europe remains uneven: Germany’s industrial engine has slowed, while France is attempting to regain stability amid political transition. Fiscal credibility will be the next test for European markets.

Asia remains the region to watch. China’s policy shift toward supporting domestic chipmakers and revitalizing its tech sector has reinvigorated investor confidence. This sharp rally underlines how sentiment can turn quickly when policy clarity returns. Going forward, consistency in Beijing’s stimulus and follow-through on its “anti-involution” measures will determine whether momentum holds.

Japan’s story continues to stand out. A weaker yen, tariff relief under the new US Japan trade agreement, and steady corporate reforms are powering both earnings and foreign inflows. The structural re-rating of Japanese equities, long anticipated, now appears genuinely underway.

India, meanwhile, is consolidating. Equity performance was more muted this quarter amid foreign outflows and high valuations, but underlying fundamentals remain sound. Financials and infrastructure remain bright spots, and the upcoming IPO pipeline could reignite momentum into year-end. Longer term, India’s domestic demand story continues to stand apart in a global landscape.

Policy Turns Dovish, But Risks Remain Uneven Across Markets

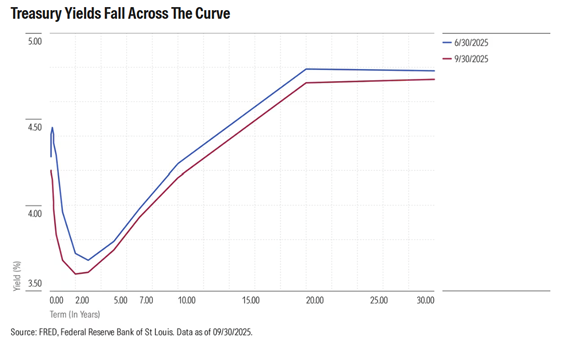

As the quarter progressed, US treasury yield decreased across the curve, with the Fed reducing the overnight borrowing rate by 25 basis points. The curve steepened, with shorter-term yields falling more than longer-term ones, signaling investor caution about the long-term economic outlook. While activity remains resilient, the labor market showed clearer signs of cooling.

The Fed cut rates at the September FOMC, with outlook being more dovish than expected, with a median expectation for an additional 50 basis points cut this year, along with improved employment and economic growth trends. Market attention shifted from upside inflation risks to downside growth risks.

European government bonds fell over the quarter, with the gap between the 10-year French and German bond yields reaching its widest level since January 2025 as France faced political obstacles to addressing its budget deficit. With rates kept at 2% at its September meeting, the ECB emphasizes a data-dependent approach, while not committing to a fixed path or rate cuts or hikes.

UK long-end yields surged in September, with 30-year Gilts hitting their highest since 1998, driven by sticky inflation and concerns over fiscal stability ahead of November’s budget. Rates are likely to stay elevated into early 2026, with the BoE cautious about cutting until inflation shows clearer moderation.

Japanese Government Bonds were the laggard of the quarter, with political and fiscal uncertainty adding to volatility. Hawkish signals from the BoJ at its September meeting put further upward pressure on JGB yields.

Crypto Surges as Ethereum Takes the Lead

Crypto markets delivered a strong rebound this quarter, driven by growing adoption of digital asset treasuries by large firms and new stable coin legislation that boosted market confidence. ETF inflows into Bitcoin and Ethereum surged, while expectations of Fed rate cuts added further support. A major whale rotation from Bitcoin to Ethereum, along with rising use of Layer 2 gaming solutions, pushed Ethereum up 66.7%, far ahead of Bitcoin’s 6.4% gain. Ethereum sprinted ahead like a hare, while Bitcoin maintained a steady tortoise-like pace- both staying firmly in the race.

In Q3 2025, silver stole the spotlight with a 29.3% gain, comfortably outpacing gold’s 16.8% rise. The rally was driven by global economic uncertainty, supply constraints, and strong industrial demand. Unlike gold, silver served a dual purpose, acting both as a safe haven amid rate-cut concerns and as an industrial asset attracting institutional interest.

Gold also delivered notable gains, posting its best monthly performance since 2009 in September, climbing 11.9% and briefly surpassing $3,800. The surge was supported by record U.S. ETF inflows of $142 billion, marking the strongest month of the year and exceeding last September’s tally by $53 billion.

Oil Faces Pressure from Rising Supply

Oil markets remained under pressure in Q3 2025, with Brent crude down 0.87% and U.S. crude falling 4.21%. Prices slipped as OPEC+ accelerated its production unwinding, leading to higher global inventories and renewed oversupply concerns. Weakening demand forecasts, rising U.S. stockpiles, and softer refining activity further weighed on sentiment. While China’s stockpiling provided brief support, it also added to the global buildup. As OPEC+ prepares to review output quotas for November, markets remain finely balanced between rising supply and the need to maintain price stability.

The Road Beyond Resilience

As we enter Q4, this is a time for discipline over euphoria. Market concentration remains high, liquidity is uneven, and geopolitical risks are far from behind us. Diversification, across regions, sectors, and currencies, will be essential to capture returns without assuming undue risk.

2025 has proven that resilience can coexist with volatility. The challenge now is to turn that resilience into opportunity.

- investment@providentiamanagers.com

- (+230) 468 1908